“Plan, Market, Profit” Be a Winner at the Game of Business!

A three-part business advisory series

Session 1 – PLAN SMART: Strategic Planning

“The first task of top management is the formulation and implementation of strategy.” – Peter Drucker

During this section you will be tasked with asking the questions of what is our business and what should it be? What are our objectives, strategies and plans? Also learn:

- Why strategic planning is important for both today’s and tomorrow’s results.

- Why business plans can be misleading.

- How to develop an intellectual framework to guide your business decisions.

- How to develop the right strategic and business plan for your business.

Dates: March 6th & 20th, 2015

Location: GSU Alpharetta Center – 3775 Brookside Parkway, Alpharetta, GA 30022

Time: 10:00 a.m. – 1:00 p.m.

Cost: $119 Per Session (Each 2 class session is $119. Take all 6 class sessions for $249 and save over $100)

To register or get information about the other sessions in this series please call (404) 413-7830 or visit our website.

GETTING TO YES: Understanding the Loan Process From Application to Closing Table

Financing remains one of the top priorities for small business owners. While the ability to secure capital in Georgia is getting better, the process is still far from being defined as easy. Attend this event to gain a better understanding of what lenders are looking for, the entire loan process and tips on how to prepare a winning package that can increase your chances of getting approved.

Topics in the workshop include:

- The different lending options available.

- The myths and realities of financing.

- The role the 5 C’s of Credit plays in the lending decision.

- Understanding banking prudent lending standards.

Lunch Being Sponsored By:

Date: March 11, 2015

Location: Club E Atlanta: 3707 Main Street, College Park, GA 30337

Time: 11:30 a.m. – 1:00 p.m.

Cost: FREE (Registration Required)

To register for this workshop please call (404) 413-7830 or visit our website.

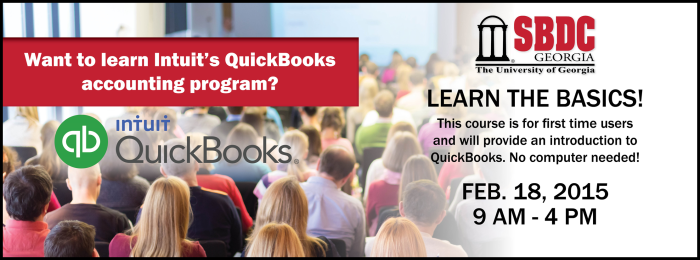

QUICKBOOKS: Step-by-Step

This workshop is designed to provide small business owners with and introduction to QuickBooks.

Course topics include:

- A review of all the important functional areas in QuickBooks.

- An introduction to the various QuickBooks software versions available and supported by Intuit.

- QuickBooks-related services including payroll, merchant credit card services, point-of-sale and other applications that integrate with QuickBooks.

Date: March 24, 2015

Location: GSU Alpharetta Center – 3775 Brookside Parkway, Alpharetta, GA 30022

Time: 9:00 a.m. – 12:00 p.m.

Cost: $69

NO COMPUTER NEEDED!

To register for this workshop please call (404) 413-7830 or visit our website.

COMPLIANCE: Are you? Are you not?

As your business grows, your challenges multiply. Small business compliance can mean the difference between protecting business operations and your company landing in hot water.

Join us as Erin Bramblett, Senior HR Specialist at Insperity, shares her expertise and discusses the various facets of compliance for local business owners. Topics include;

- Government Compliance Reporting

- HR Infrastructure

- Employer Liability Management

- FLSA and Paid Time Off Benefits

Date: March 25, 2015

Location: 55 Park Place, Training Room 1, Atlanta, GA 30303

Time: 10:00 a.m. – 12:00 p.m.

Cost: $49

To register for this workshop please call (404) 413-7830 or visit our website.

*Funded in part through a cooperative agreement with the U.S. Small Business Administration. Reasonable accommodations for persons with disabilities will be made if requested at least two weeks in advance. Please contact Mary Phillips at (404) 413-7830 or email: atlanta@georgiasbdc.org. Refunds will be issued for cancellations made one business day prior to the program date. No refunds will be issued thereafter.*